Baby Boomers and Genx Expenditures on Cannabis Chart 2019

Millennials are i of the largest generations in history, and they're hitting their prime spending years. These are the industries that stand to benefit the most.

Popular media coverage of millennials often fixates on the industries the generation is allegedly killing and their supposed fiscal irresponsibility.

Merely now, Generation Y is entering its prime number spending years — and information technology'due south set to receive $30T in wealth from baby boomers and Gen Ten.

This transfer of wealth has already begun transforming a range of industries. Some industries benefiting from millennials' increased spending power, such equally travel, reflect well-worn Gen Y tropes like the general preference for "experiences" over objects. Others, like car ownership and camping, show that many of the claims virtually millennials' unlike spending habits are overblown, and that significant continuities exist between Gen Y and their parents and grandparents.

However, these industries won't thrive unchanged.

The companies that volition come out on top are those that are reorganizing and reprioritizing effectually Generation Y. This means they're embracing irresolute preferences to offer more sustainability, affordability, and flexibility in their products and services. They're besides embracing new technology and the unprecedented discoverability and customer connections information technology allows.

In this report, we dive into some of the industries — from frozen foods and fast coincidental dining to micromobility and personal finance apps — that could massively benefit from the rise of Generation Y.

TABLE OF CONTENTS

Activities & hobbies

1. Camping manufacture

two. Fitness industry

3. Travel manufacture

Consumer goods

4. Fast casual dining manufacture

5. Java industry

six. Frozen foods industry

seven. Seltzer industry

8. Houseplant manufacture

9. Skincare manufacture

Transportation

10. Automotive industry

11. Micromobility industry

Finance

12. Personal finance industry

12 Industries That Volition Thrive Thank you To Millennials

Millennials are one of the largest generations in history, and they're hitting their prime spending years. Get the full report to notice out about the industries that stand to do good the most.

Activities & hobbies

1. Camping industry

Equally more millennials take children, they're embarking on camping ground adventures in the great outdoors as families

Camping has enjoyed significant revenue growth over the terminal several years, largely thanks to millennials.

Total wholesale camping equipment sales rose to a higher place $3B in 2020, up from less than $2B in 2013. Also in 2020, nearly 94.5M American households went camping — a new high.

Kampgrounds of America, an association of almost 500 Northward American individual campgrounds, says the manufacture's "aggressive growth" is largely attributable to an influx of younger campers, who are camping ground in larger numbers and more oft. In 2020, 37% of total reported campers were millennials — 6 percent points higher than millennials' representation in the total US population, according to KOA'south North American Camping Report.

More than 10M households went camping for the very first time in 2020, accounting for 21% of all campers — a rate 5x higher than 2019. Millennials are strongly represented in this cohort, with nearly threescore% of first-time campers under the historic period of 40.

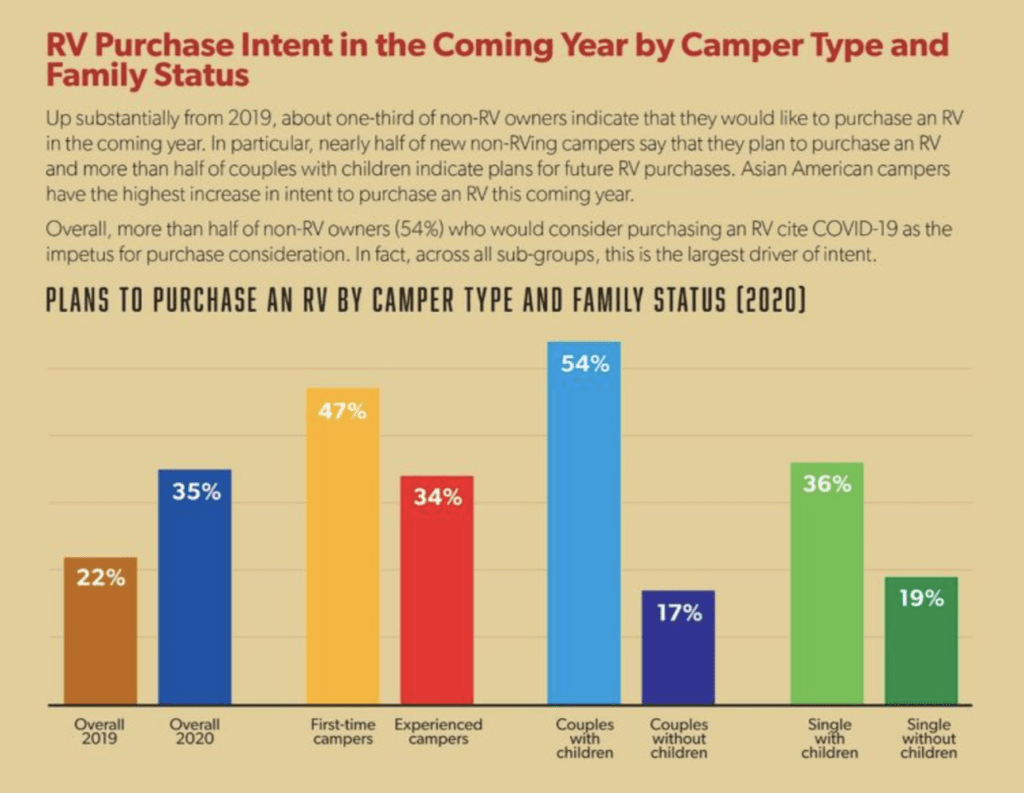

In addition, recreational vehicle (RV) ownership has risen significantly amid millennial campers. In 2019, 57% of millennial campers surveyed reported owning an RV, a figure that increased to 70% in 2020.

Part of millennials' enthusiasm for camping ground springs from the fact that many of them are entering their prime number spending years and starting families of their own. Over 1M millennial women are becoming mothers every twelvemonth, pregnant Gen Y now makes up the majority of annual births in the US, according to the National Centre for Health Statistics.

These shifts are creating a need for upkeep-friendly family unit recreational activities. 50% of existing millennial campers say that having children and increased spending power has made them want to camp more frequently. 64% of families with children intend to have more camping trips in 2021, and similar sentiments are driving interest in RV ownership, suggesting a lasting upward trend in outdoor family recreation.

Source: Kampgrounds of America

Another force driving the growth of camping ground among millennials is the popularization of new accompanying experiences that offering greater condolement and amenities. These can assist mitigate challenges similar finding a campsite, dealing with bugs, and safety. They tin can also make a military camp more family-friendly, with additions like basketball game courts, themed weekends, satellite Tv, and total-featured bathrooms. To this cease, "glamping," a term encompassing more upscale elements than the traditional camping ground trip, is on the rise, particularly with first-time campers who may be hesitant about the traditional camping experience.

Finally, technology is helping millennials learn more than about camping and find camping experiences.

Virtually all campers report bringing some kind of tech device with them camping, primarily in case of emergencies or to enquiry safety bug. Showtime-time campers and parents are the most likely to base a camping trip decision on the availability of technology, with parents being specially sensitive to amenities such as Wi-Fi, and the provision of such services has a substantial impact on the length of campers' stays.

Online platforms like Hipcamp and Campsy have emerged to assist campers volume unique lodging experiences like yurts, treehouses, and caves. Hipcamp, which has been described as "the Airbnb of the outdoors," raised a $57M Serial C circular in January 2021 at a valuation of $300M, more than double its valuation in 2019.

Social media is also helping campers find new places to visit, then share their experiences with others: 30% of millennials say that they accept picked a camping ground spot later on seeing someone else go there.

New technology, the rise of high-terminate camping, and millennials' emerging roles as parents and full-fledged earners are changing camping ground. In one case a niche form of relatively inaccessible outdoor recreation, camping ground now more closely resembles an alternative travel manufacture, with a range of lodging and experience options. Near chiefly, information technology is an even more than kid- and family-friendly activity than information technology in one case was — essential for the generation that now makes up the majority of new parents in the US.

2. Fitness manufacture

Boutique GYMS & CLASSES ARE spreading AS MILLENNIALS SEEK Selection AND Community

Few industries will benefit as directly from the rise of millennials' economical power as the fitness manufacture.

Generation Y is already more motivated to stay in shape than previous generations: over three-quarters of millennials (76%) exercise at least once a week, compared to seventy% of Gen Xers and 64% of baby boomers.

Millennials are also much bigger spenders when it comes to gym memberships, dropping almost $7B annually — double the amount spent past Gen Xers and boomers.

Source: Bruce Mars/Pexels

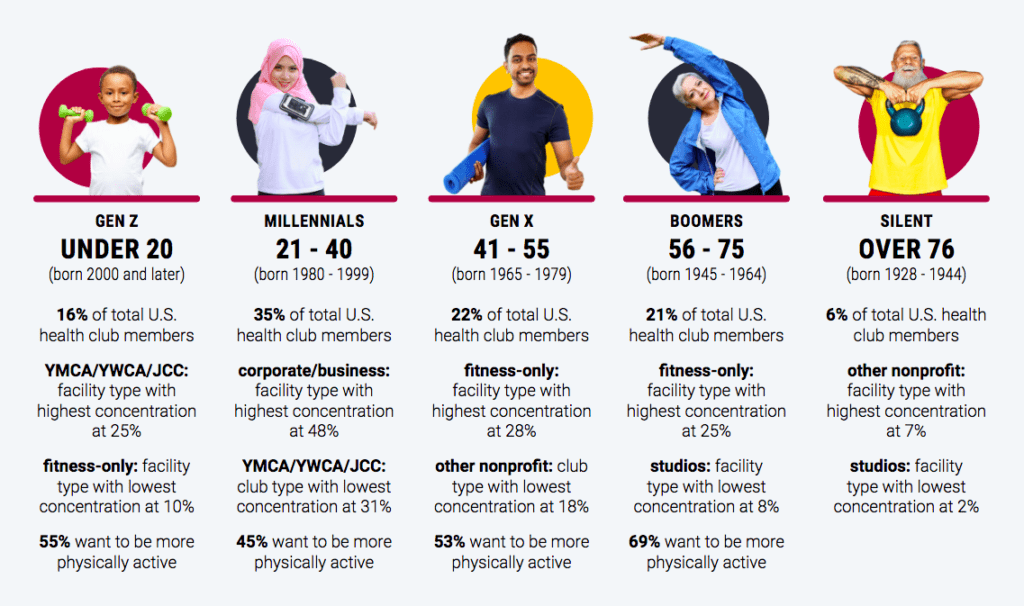

Millennials stand for 35% of all health club memberships in the US, the single largest generational cohort past a pregnant margin, co-ordinate to the International Health, Racquet & Sportsclub Association (IHRSA). Millennials are also about probable to subscribe to an online fitness service, with more one third of millennial consumers subscribing to at to the lowest degree one online workout service or production.

Source: IHRSA

Millennials also differ in terms of how they spend on fitness, tending to steer clear of traditional full-service gyms similar Gold'due south Gym or LA Fitness. In fact, despite Generation Y's enthusiasm for practice, mid-market fitness clubs have actually seen their memberships stagnate over the years.

Instead, the fitness industry is seeing growth at the ends of the spectrum: budget gyms and boutique studios.

The number of people who joined a budget gym — fettle clubs that charge members $xx per month or less, such every bit Planet Fettle — increased by almost seventy% in 2015 solitary, according to IHRSA. The gyms offer a broad variety of amenities, often including classes, at a fraction of the cost of a traditional mid-market gym membership.

At the same time, boutique studio memberships have soared, growing an estimated 121% betwixt 2012 and 2017, according to IHRSA. The customers at these bazaar studios — including places like SoulCycle, Rumble, and Pure Barre — are firmly in the millennial camp, with the majority averaging 25 to 44 years erstwhile, according to ClubIntel.

Boutique fitness studios typically cost significantly more than traditional gyms, with average monthly membership fees of around $ninety compared to the $51 average beyond other gym facilities. This does non, still, diminish their appeal among millennial consumers, suggesting this cohort is likely to spend higher sums for superior workout experiences.

Millennials' willingness to pay upward, despite their unique financial pressures, may be partially driven by their tendency to view practise equally a social group activeness rather than an individual one. One 2014 survey found that 63% of people who attended boutique studio gyms did then because of the "community attribute formed by other people attending," with some other 47% attributing their omnipresence to the atmosphere.

Some brands, such as Peloton, accept harnessed the community aspects of working out to groovy effect — a miracle Peloton has leveraged into strong sales and sustained growth, even as Covid-19 drove consumers to work out from dwelling house, rather than in the studio.

This customs aspect could assist studio gyms earn the loyalty of millennial customers. Gym-goers who experience connected to a particular lodge or class are more likely to stick effectually as members.

To concenter millennial clients, some old-school gyms are adapting their models to capitalize on the increasing popularity of the boutique studios. In 2017, Gold'southward Gym debuted a series of "coach-led, customs-driven and individually adapted boutique-way classes" under the Gold'southward Studio moniker, which went live in 40 of its 700+ locations.

While millennials are more than eager to do — and more willing to pay for it — than any generation before them, it'due south unclear which fitness manufacture players volition come out on top as Gen Y enters its spending prime.

US health clubs have already rushed to capitalize on millennials' devotion to self-improvement, with the volume of Us health clubs increasing past 20% between 2011 and 2015. Simply it remains to be seen whether this expansion will ultimately look similar a bubble, as the trendy nature of many health clubs may brand them simply every bit susceptible to turnover as traditional gyms, if not more.

What does seem certain, given millennials' proclivity for health and working out, is that the fitness industry's growth shows no compelling signs of slowing down.

iii. Travel manufacture

MILLENNIALS ARE SEEKING OUT MORE AFFORDABLE, BESPOKE TRAVEL ARRANGEMENTS

With an appetite for meaningful travel experiences and access to new online platforms that make customized travel easy, millennial travelers are looking to cut out middlemen and invest in their own bespoke travel experiences — without paying a college cost.

This has triggered a reorganization of priorities for an industry that has long focused primarily on highly-seasoned to infant boomers, a retired and relatively deep-pocketed demographic with plenty of free time. Even so, millennial consumers have proven just as keen to see the world every bit their parents and grandparents.

Source: Gratisography/Pexels

An Airbnb written report plant that many millennials prioritize saving for their next trip over paying off debts or saving to purchase their beginning domicile. Another found that 21% of millennials would accept a lower bacon if it meant they could travel more frequently. The bulk of Generation Y would even be willing to sacrifice their Netflix subscription, coffee, alcohol, carbs, and sex in favor of traveling, according to Forbes.

Many millennials are excited almost the prospect of traveling in a post-pandemic world. A majority have either already booked a trip for 2021 or expect to do so in the near hereafter, according to Airbnb. And millennial travelers are already planning to outspend other generational cohorts, with an boilerplate of $5,462 saved for their adjacent trip compared to the average of $iii,444, according to Expedia.

Notwithstanding, while many millennials are eager to hit the road, the pandemic has prompted many travelers to reassess what they're looking for in their side by side break. Travel to visit family has become significantly more than important to many consumers, and more travelers are prioritizing safety than they were in the past.

Merely while millennials are but as eager to meet the globe as older travelers, their tastes are markedly dissimilar, and traditional holiday packages are unlikely to meet their high expectations. Many are turning their backs on traditional guided sightseeing tours and bus excursions in favor of more authentic travel experiences.

"Destinations need to meliorate their experiential offering. Traditional attractions and former buildings and churches practise not suffice anymore. Music festivals, cultural and culinary events, multi-twenty-four hours dance parties and artistic happenings all must be on the menu of destinations looking to attract more millennials." — Michel Karam, founder and CEO, müvTravel

Traveling millennials want to observe hidden gems and local favorites that capture the truthful essence of a destination. Services like Airbnb and VRBO directly entreatment to this, eschewing traditional hotels to allow tourists to live like locals.

At the same time, millennials are besides demanding when it comes to cost. The ubiquity of price-comparison apps and the convenience of e-commerce are making it easier than e'er for frugal millennial travelers to discover bully deals, and 85% of millennial travelers check multiple sites earlier making a commitment.

Every bit with many industries in today's information economic system, millennial travel trends are strongly influenced by social media. Research has found that 87% of millennials on Facebook use the site for travel inspiration, making it the most influential social media platform for Generation Y travelers thinking about their next trip, according to Req. In addition, 82% of millennial travelers said they consider user reviews an important factor when planning a trip, and 76% decided upon a destination based on the recommendation of a family fellow member or friend.

While the combination of millennials' high expectations, budget-conscious mindset, and desire for authentic experiences poses unique challenges to traditional travel businesses, it also means greater opportunities for companies fix to cater to Generation Y's discerning tastes.

Every bit fastidious planners and price-conscious consumers, Gen Y travelers are likely to adopt third-party platforms and marketplaces where they can more precisely customize their feel. Concatenation hotels looking to regain market share lost to emerging accommodation marketplaces will need to either embrace this millennial preference or observe another style to attract millennials back to their businesses.

In 2018, Marriott International opened a hotel designed specifically for young travelers in Tampa, while Hilton began building a new iteration of its millennial concept hotel, Tru, in Baltimore. The relatively modest, stylized rooms at Tru cost less than $100 a night and feature a smartphone-powered cheque-in system, designed for affordability and efficiency.

At Hyatt Axial — a Hyatt concept designed for millennials — staffers are encouraged to share recommendations with guests, and guides to local breweries and restaurants are placed in rooms. Meanwhile, Residence Inn Marriott locations host weekly mixers designed to give millennial travelers social get-togethers that bring them closer to the local flavor of their destination.

For the former guard of the travel industry, attracting millennials by building out better applied science, service, and affordability is an existential requirement. As Smashotels president and CEO Scott Greenberg put it:

"If we attract young people, old people will show up. Merely if you build a hotel for old people, immature people never show upward."

Consumer goods

four. Fast casual dining industry

MILLENNIALS opt FOR SPEED, SELECTION, AND Multifariousness WHEN THEY Eat OUT

Problems in the casual dining manufacture came to a head in 2017, as popular chains similar TGI Fridays and Applebee's were forced to shutter dozens of locations amid slumping sales and reduced traffic. The principal culprit, according to analysts, was millennials — a generation that allegedly no longer goes out to swallow, preferring to melt or order takeout.

The reality is that coincidental dining chain sales are down among all demographics, not just millennials. Millennials are not avoiding restaurants — in fact, no generation has a higher percentage of frequent eating place visits. In 2019, millennials spent nearly half their monthly food budget on dining out or takeout, surpassed only by Gen Z. As of early 2020, 72% of millennial consumers frequented eating and drinking establishments on a weekly basis.

What's changing is that millennials are turning away from old-school chain restaurants and embracing new fast casual dining concepts.

Millennials are price-sensitive and eager for healthy, fresh food options, and they crave choice in their restaurant experiences. Virtually 40% of millennials eat meals on the go, compared to 26% of Gen Xers and 19% of infant boomers, according to a Technomic inquiry study, and more than than fifty% want a "good deal for their money."

Fast coincidental restaurants from Chipotle and Subway to Shake Shack and Five Guys are largely designed with these preferences in mind, with fast ordering and app-powered pickup and delivery as basic pillars of their model. Fast casual dining also has an average check size effectually $9-$xiv, compared to less than $9 for fast food and as much as $20-$50 for higher-end casual dining. This gives millennials a dining option that doesn't sacrifice also much quality for affordability.

The fast coincidental manufacture has also seen a wide proliferation of varied cuisines and tastes. From the successful vegan outlet Past Chloe to the plant-based sandwiches at Next Level Burger to the sushi kiosks of Miso Ko, there's a fast casual option for nearly whatsoever ready of dietary restrictions and ethical choices.

Traditional dining and fast food bondage looking to update their offerings for Generation Y need to consider non just their prices and menus, simply likewise how they tin can integrate with engineering science, the caste of personalization they offering in their meals, and their arroyo to health.

Chipotle pioneered the trend toward the fully customized fast coincidental meal with its fabricated-to-order burritos and bowls. Chains like Blaze Pizza are following in its footsteps: at Blaze, customers can fully customize their pizza and have it cooked in forepart of them in simply 3 minutes.

As consumer food preferences evolve, Fatburger experimented with offering a constitute-based burger in 2018 and found millennial customers were willing to pay more for the higher-quality product. Other bondage accept also been quick to respond to heightened involvement in constitute-based meat alternatives. Burger King, Cheesecake Manufactory, Red Robin, and Qdoba are just some of the nationwide chains that accept introduced plant-based meat products from Impossible Foods. Similarly, bondage including Carl's Jr., Dunkin', and TGI Fridays take all begun serving meat-free alternatives from Beyond Meat.

Technology too plays an important part in the fast coincidental manufacture. 25% of fast coincidental diners say that technology options are an important factor in their option of eatery, according to the National Restaurant Clan.

From Starbucks to Panera, chains are embracing mobile ordering and in-store pickup to attract a busier, millennial audition. Meanwhile, Burger Rex and Chipotle accept defended bulldoze-thru lanes for online orders. Chipotle's online drive-thru pickup service, named "Chipotlanes," was so popular with consumers that the retailer reported an increase in online orders of more than 65% in a single quarter in 2019, representing virtually 13% of the chain's overall sales.

Many restaurants are now offering menus via QR codes, in-app table service, and other technology-axial options for diners. Cocky-service kiosks, like those at Subway and McDonald'due south, are showtime to emerge at fast casual locations besides. Ashely Morris, CEO of Capriotti's Sandwich Shop, predicts widescale adoption of such applied science in the front- and back-of-business firm in the long term.

Nonetheless, more traditional casual dining may get a heave as more millennials have children. Designed for longer sit down-down meals rather than grab-and-get cuisine, these kinds of restaurants serve the need for a "third-infinite" restaurant — a identify where parents can go with kids to unwind without being hurried out the door.

A claiming for the fast casual dining restaurants of tomorrow will be building establishments that can be every bit family- and kid-friendly without sacrificing the cardinal factors that brand them appealing to millennials today.

12 Industries That Volition Thrive Thanks To Millennials

Millennials are 1 of the largest generations in history, and they're hitting their prime number spending years. Get the full report to find out well-nigh the industries that stand to benefit the nigh.

five. Java industry

MILLENNIALS Love Java — AND THEY'RE WILLING TO PAY More FOR GOURMET PRODUCTS

Similar Generation X and the infant boomers earlier them, millennials drinkable a lot of java. They also started drinking coffee much younger — on boilerplate, effectually 15 years erstwhile. Later on several years of failing sales among most age groups, millennial consumers are the vanguard of a resurgence in the coffee industry. Today they account for approximately 44% of the beverage's demand in the US.

But while millennials' java consumption isn't slowing, it is changing.

Instead of store-bought and pre-packaged coffee, millennials are seeking out cold brew and other specially prepared beverages, also as ethically sourced, sustainable, and gourmet products.

Source: Burst/Pexels

Many millennial consumers are looking across older, legacy coffee brands to blends from bazaar "3rd-wave" coffee roasters. Recent data shows that 70% of by-day java consumed by millennials is considered "gourmet."

Millennials are also gravitating abroad from hot coffee toward canned common cold brew and nitrogen-infused beverages. The can format is user-friendly for on-the-get consumers, while different flavors and styles offering a range of options for choosy customers.

Environmentally conscious millennials are besides taking a much more active involvement in how and where their coffee is grown, and that's influencing their ownership decisions. Many Gen Y consumers are at least somewhat knowledgeable about their coffee, favoring brands committed to fair trade and environmentally sustainable growing practices.

Millennial interest in the sustainability of their coffee isn't express to the beans themselves. Many Gen Y consumers are exploring alternatives to traditional dairy products in their coffee and flocking to retailers catering to this demand.

Oat milk, in particular, has seen strong growth among millennial consumers seeking alternatives to dairy milk. Nicole Ferris, managing director of London-based specialty coffee store Climpson & Sons, said that in 2020 her store observed a l-sixty% increase yr-over-year in demand for oat milk in hot and common cold coffees, a trend Ferris believes will continue as interest in constitute-based diets gains momentum.

Millennials' love of coffee is a positive sign for java growers and brewers. Demand for premium coffee is unlikely to diminish in the nigh future, creating favorable market conditions for incumbents and new entrants akin.

With the ever-increasing corporeality of choice in the coffee space, manufacturers need to await to differentiate their offerings if they want to attract millennial attending — and they have a wide range of strategies to exercise so, from calculation additional caffeine to promoting ethical or sustainable sourcing to experimenting with new ingredients like protein powder, nootropics, and CBD.

6. Frozen foods industry

CONVENIENCE-SEEKING MILLENNIALS ARE DRIVING A RENAISSANCE IN THE FROZEN Aisle

The frozen food sector, which is expected to be worth over $400B by 2027, has long had something of an image trouble. Frozen foods might be user-friendly, merely until recently, they were not typically associated with good for you eating or seen as a desirable alternative to freshly prepared meals.

Gen Y may exist changing that.

Millennials' irresolute preferences around food and health are resulting in a renaissance of frozen foods, a resurgence in sales, and the emergence of new startups creating and delivering bespoke frozen meals. In 2017, millennials spent an average of 9% more than on frozen foods per trip to the grocery store than households of other demographics. In 2018, the total volume of frozen foods sold in the US increased for the first time in v years, driven largely past millennials and consumers with children.

In 2020, with much of the world stuck at domicile because of the Covid-19 pandemic, sales of frozen food soared. The market experienced retail sales of $65B in 2020, an increase of 21% over the previous yr, according to the American Frozen Nutrient Plant (AFFI). Baby boomers, women, and unmarried individuals accounted for meaning increases in frozen food sales, but older millennial consumers remain the largest consumer market for frozen foods.

Beyond the bear upon of the pandemic, several factors are driving millennials' involvement in frozen foods. Gen Y has a professed appreciation for convenience and eating on the go, and frozen foods tin can be a fast and affordable alternative to ordering commitment or going out to swallow.

Economical factors may besides be contributing to this shift. For millennials burdened with stagnating wages and significant student loan debt, affordable frozen foods have become increasingly highly-seasoned.

"Something every bit uncomplicated as buying frozen food is really just symptomatic of the trends we're seeing at big. When y'all're seeing $400 dollars come out of each paycheck to pay a educatee loan, that'south certainly going to impact your ability to become grocery shopping in a way that people more traditionally used to." — Allie Aguilera, policy and government affairs managing director, Young Invincibles

Another factor at play is the surge in the availability of healthy frozen foods. Traditionally, frozen food options have not been highly various or healthy in their offerings. There has, notwithstanding, been a huge increase in the number of Americans identifying as vegan: from 2014 to 2018, this number grew 600%.

Frozen food manufacturers are racing to capitalize on the popularity of plant-based diets among millennials. 52% of millennials adopt organic food, and a massive 40% are eating a institute-based diet.

While plant-based diets accept gained in popularity among babe boomer and Gen X consumers, millennials have adopted new dietary habits much more readily. 22% of millennials have experimented with a vegetarian diet, compared to 13% of Gen 10 consumers and xi% of baby boomers. Similarly, rates of veganism are significantly higher amid millennials (xvi%) than baby boomers and Gen X, at 8% and 7%, respectively.

Source: Wikimedia Commons

Source: Wikimedia Commons

Constitute-based brands such as Gardein (owned past Pinnacle Foods, which as well owns the popular Birds Center frozen food brand), Daiya (acquired by Japanese pharmaceutical visitor Otsuka Pharmaceutical in 2017), and Sugariness Earth (owned by Nestlé) have all fabricated significant gains in the frozen food market in contempo years — and the trend shows no signs of stopping.

In add-on to launching new products, brands such as Gardein are making further inroads into the freezer alley past partnering with manufacturers of frozen ready meals to incorporate plant-based meat alternatives into other products, such as Healthy Choice'due south Ability Bowls.

Amy'due south, which offers a range of vegan options in addition to its core products, saw strong growth in consumption of its frozen entrees in 2020. The market has seen new entrants such as Alpha Foods, which raised a $28M Series A round in December 2019, diversify their product lines into convenience frozen foods such equally pot pies and microwaveable burritos.

Millennial consumers also look frozen foods to be higher-quality than they were in the past. For example, Conagra Brands, which owns the Feast brand of frozen set up meals, doubled down on product quality post-obit a management shake-up in 2015 to meet heightened consumer expectations.

Other brands have emerged to capitalize on the gourmet frozen nutrient trend, including Frozen Foodies, which offers cryogenically frozen meals prepared by professional chefs using gourmet ingredients. Meanwhile, Buttermilk focuses solely on pre-made Indian meals that can be reheated in the microwave at home and served immediately.

Daily Harvest offers a frozen smoothie and basin subscription delivery service and advertises heavily to millennials on Instagram. Since launching in 2015, Daily Harvest has achieved annual sales of $125M and has raised $44M in equity funding.

Wider selection, higher quality, and more than competitive pricing are all likely to drive frozen food sales in the virtually future. However, as consumers' expectations increase, so too will manufacturing costs. The biggest claiming legacy frozen food companies confront isn't convincing a new generation of consumers of the benefits of frozen nutrient; it's how to manufacture and price higher-quality products competitively without cut as well deeply into turn a profit margins.

seven. Seltzer industry

DITCHING SODA, MILLENNIALS SEEK A HEALTHIER FIZZ IN THEIR DRINKS

While many millennials have little appetite for sugary sodas, that doesn't hateful they aren't looking for other carbonated beverage options — and they're finding them in seltzers and flavored sparkling waters.

Sales of sugary carbonated drinks have been on the decline for years, with many of the largest soda manufacturers going back to the drawing board equally consumers plow toward healthier alternatives.

The beverage industry has been quick to respond to these trends. In recent years, the dramatic increment in seltzer's popularity has sparked an arms race amid major beverage manufacturers every bit they seek to shore up their losses on soda with sales of low-calorie carbonated drinks.

Sparkling waters, in particular, accept proven remarkably popular with wellness-conscious consumers. In 2020, the category drew $three.5B in sales, with brands like Sparkling Ice and Perrier reporting potent sales. Newer entrants such equally bubly, a PepsiCo brand launched in 2018, take quickly achieved similar sales totals as established legacy brands, suggesting in that location may yet exist room for new sparkling water products to meet heightened consumer need.

Like PepsiCo, several other major drinkable manufacturers have diversified their product offerings to include flavored seltzers, often adopting an acquisitive approach. Coca-Cola acquired Mexican seltzer brand Topo Chico, which has long been pop across the American Southwest, for $220M in 2017. Coca-Cola also offers sparkling water beverages through its Dasani and Smartwater brands. PepsiCo owns Izze, a range of juice-seltzer blends, also as bubly and SodaStream.

LaCroix, long a favorite drink among millennial consumers, saw stiff sales throughout 2020 equally more consumers were introduced to the brand. LaCroix's parent company, National Beverage Corp., reported $246M in net sales during the 3rd quarter of financial 2021, an increment of x% year-over-yr and one of the company's strongest-ever quarters. Prior to the pandemic, National Drink experienced a dramatic subtract in sales and an accompanying decrease in its stock price of almost iii% following reports that sales of LaCroix were "in free fall" due to intensifying competition in the space.

In addition to major brands, dozens of smaller contained beverage companies have emerged to quench millennials' thirst for flavored seltzers. Spindrift, which claims to be the first sparkling water in the US to be flavored exclusively using real fruit juice, has grown rapidly since its founding in 2010. The company achieved revenue growth of more than 1,000% over a 36-calendar month period from 2016 to 2018. In 2020, Spindrift raised an additional $33M in equity funding.

Other upstarts are looking to capture the attention of millennials by calculation new ingredients into the mix — most notably, CBD and booze.

Recess, a CBD-infused seltzer brand, opened an online shop to sell its hemp-infused CBD seltzer in early 2019. The product is marketed as a health aid, and likewise contains supplements like Fifty-theanine, an amino acid establish in tea leaves.

White Claw Difficult Seltzer (owned by Mark Anthony Brands), meanwhile, produces a range of flavored 100-calorie alcoholic seltzers. In 2019, White Claw sales surpassed that of any arts and crafts beer except for Bluish Moon. That twelvemonth, information technology represented 58% of total hard seltzer sales.

Across the lath, sales of hard seltzers increased by more than than 226% in 2019; by comparison, total sales of beers increased by less than ane% during that period. In May 2020, weekly sales of difficult seltzers in the Usa reached $105M, dwarfing the $28M in sales reported during the same menstruum in 2019.

Since then, the market has attracted several new entrants with like products. Two Robbers, an independent hard seltzer brand launched in 2017, raised a $6M Series A round in Apr 2021. Volley, a tequila-based seltzer company, launched in March 2021, the outset such product on the market.

In light of the stiff growth among contained brands in the infinite, established brewers such every bit Anheuser-Busch InBev SA (Budweiser, Michelob), Molson Coors (Blueish Moon, Carling, Molson), and Constellation Brands (Corona, Modelo) have made moves into the hard seltzer space, which represents one of the strongest growth opportunities in the alcoholic beverage market. Hard seltzers are expected to reach annual sales of $6.5B by 2024.

For established brands, the biggest challenge may not exist catering to changing tastes, simply reinventing themselves to capitalize on their strong make recognition while shifting focus away from product lines that may be stale or perceived every bit unhealthy, such equally sodas.

8. Houseplant manufacture

WELLNESS-FOCUSED URBAN MILLENNIALS BRIGHTEN THEIR SURROUNDINGS with plants

In 2019, Bloomberg declared that plants had go the new children for Generation Y. The Washington Post went farther withal, saying that millennials were filling their homes — also as the "void in their hearts" left by not having children or pets — with houseplants.

There are a couple of bug with this narrative. For one thing, millennial women account for a majority of births in the The states. Meanwhile, roughly a third of all pet owners in the land are millennials, making them the largest pet-owning generation — so, many millennials dohave children, pets, or both. Moreover, there's non much testify that people run across houseplants equally substitutes for children or pets.

That said, constitute sales are on the ascent. Between 2016 and 2018, they increased in the US past nearly 50% to reach $i.7B, according to the National Gardening Association. During that catamenia, the average household spend on indoor plants grew from almost $xxx to nearly $l.

Involvement in houseplants has continued to increase steadily in the intervening years, specially equally people sought to adorn their living spaces during Covid-19 lockdown measures. Almost two-thirds of independent garden centers polled by Garden Center Magazine saw increases in houseplant sales of more than than fifteen% in 2020. 96% expected to see farther increases in sales throughout 2021.

Beyond the pandemic, forces behind the demand include millennials' involvement in holistic wellness and proclivity for urban living, where the temporary nature of rentals often doesn't let more permanent changes to ane's housing. On the supply side, a range of new digitally native D2C found brands have sprung upward to offering an easier and more than accessible houseplant buying experience.

Houseplants accept become an integral function of many Gen Y consumers' wellness and self-care routines. On social media, terms like "jungalow" — a portmanteau of "jungle" and "bungalow" — and "urban wilding" accept become pop hashtags for stressed-out millennials hoping to create urban oases in their apartments.

D2C establish brand The Sill's tagline, "Plants Make People Happy," directly contextualizes houseplants as a form of self-care and wellness.

"They call us Generation Stress for a reason. We position plants and our brand as the break in all this. Information technology's the antidote to this unfortunate thing that our entire generation suffers from: feet. And plants really can be office of the cure." — Eliza Blank, CEO of The Sill

Advocates regularly cite scientific studies showing houseplants can increase productivity, reduce stress, boost concrete wellness, and improve air quality. While recent research shows that houseplants have a more often than not negligible effect on indoor air quality, the mood-changing effects of surrounding yourself with plants are existent and clear.

Also important in the resurgent growth of the houseplant manufacture is the "youthification" of America'south urban areas. Millennials today take a preference for metropolis living that eclipses that of baby boomers and Generation X at the same historic period, and they tend to rent more than other generations: 74% of millennials alive in rental properties, compared to 61% of early boomers in 1981 and 62% of Gen Xers in 2000.

While renting is more than affordable in the short-term and makes city living more possible, it also makes it harder to personalize and customize a living space. Plants offer a low-toll, low-bear upon way to do this.

And equally millennials seek out greenery to raise their living spaces, retailers aren't waiting passively for customers to come to them; instead, they're adapting their offerings to reflect irresolute shopping habits among millennial consumers.

D2C houseplant companies like The Sill, Greenery NYC, and Bloomscape offering highly cultivated aesthetics designed to be constitute and shown off on social media. They also offer meticulous constitute care instructions and prioritize online sales.

Several houseplant subscription services have emerged in contempo years, including Click and Grow, Horti, and The Sill's Plant Parent Club. Larger e-commerce platforms similar Amazon and Etsy take too launched specialized marketplaces for houseplants. These services non but make cultivating and caring for houseplants easier for busy urban consumers, but also strongly align with broader e-commerce trends that are popular with millennials.

Similarly, many apps have launched in contempo years to assistance new houseplant owners tend to their greenery, including Greg, which raised a $5.4M seed round in May 2021. Like other apps in the infinite, such every bit Blossom, Florish, and Planta, Greg helps people have meliorate care of their plants by using machine learning to offer personalized watering schedules and assist with optimal plant positioning based on factors such as the availability of natural low-cal in the habitation.

While these trends may threaten traditional garden retailers, some independent nurseries have adapted and found success with millennial shoppers. California's Folia Collective, Sanso, and Peacock & Co. have attracted millennial shoppers by embracing the clean, athwart aesthetics of companies like The Sill and focusing their sales on houseplants — advisable for a generation that'south more than likely to accept space for indoor than outdoor plants.

By offering hands available, aesthetically clean, and lower-cost houseplants, found retailers of all stripes can better appeal to wellness-minded and urban-home millennials.

9. Skincare industry

DRIVEN BY CONSCIOUS CONSUMERISM AND ONLINE-FIRST strategies, SMALLER COMPANIES Proceeds GROUND ON LEGACY COMPETITION

Over the terminal several years, the cosmetics industry has seen strong growth, driven largely past millennials' new discovery and purchasing behaviors and the rise of niche brands catering to their preferences.

As of 2017, millennial shoppers were buying 25% more cosmetics than 2 years prior, and significantly more than babe boomers, with self-described "makeup enthusiasts" using 6 or more products each day, according to NPD.

Beyond dazzler, both online and in-store sales have increased since then: per a PowerReviews consumer survey, 49% of respondents indicated they spent more than $l on beauty products online in 2020, compared to just sixteen% in 2019. 41% spent more than $50 in shop during 2020, compared to 21% in 2019.

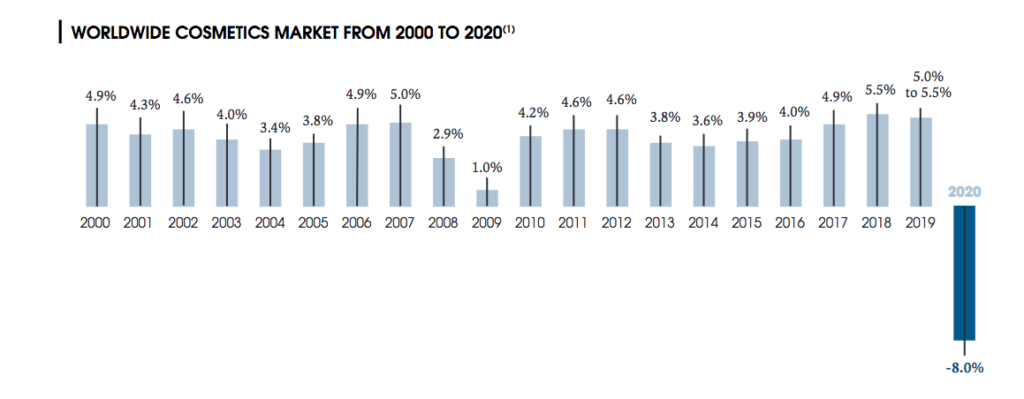

Notwithstanding, with salons and retail points of sale closed, the coronavirus pandemic had a pregnant affect on the cosmetics industry'south rate of growth. According to information from Fifty'Oreal, the global cosmetics industry shrank by 8% in 2020.

Source: Fifty'Oreal

However, the skincare category has been a bright spot for cosmetics. Fifty'Oreal notes that skincare "remains the leading correspondent to the growth of the dazzler marketplace." While interest in categories like makeup waned during the pandemic as consumers had fewer social engagements, skincare became an area of focus every bit people looked for ways to take care of themselves at home.

The millennial generation is not only flocking to skincare products; information technology as well represents changing preferences effectually how to find and choose skincare brands.

Millennials are 3x more than likely than previous generations to inquiry new brands and products using social media, and 37% more likely to trust a brand later on coming across a sponsored post about it. Beauty videos in particular are on the ascension: global views of beauty videos on YouTube increased by 60% to a full of 219B between 2016 and 2017. Influencer marketing is especially constructive when targeted toward millennial consumers, with 66% of millennials indicating that social media trends afflicted their cosmetics purchasing decisions in 2020.

This tendency to use social media to find products has spurred the growth of new online-first and D2C dazzler brands like Glossier, which has used Instagram as its primary marketing aqueduct and surpassed $100M in sales in 2018.

Meanwhile, brick-and-mortar beauty brands similar Ulta Beauty are embracing niche merchandising as a strategy to lure consumers. Ulta has worked with the Kardashians, become the exclusive retail partner of popular skincare make Peach & Lily in early on 2019, and announced that ane,200 Ulta Beauty stores will acquit D2C company Madison Reed'southward products. While some cosmetics and dazzler brands struggled to mitigate the touch of the pandemic, Ulta achieved ten% revenue growth in 2020, and the company experienced a tape-breaking Q1 fiscal 2021, with a 66% increment in twelvemonth-over-yr comparable sales.

Millennials continue to bulldoze innovation in skincare through their purchasing decisions. While millennials are generally price-conscientious, 73% are willing to pay more for products that are sustainable (compared to 66% of boilerplate consumers), with a lack of testing on animals as their highest priority.

They also want to buy natural, high-quality products, with a particular focus on sustainability. Amidst the pandemic, 76% of consumers indicated that they are proactively seeking out brands and products that are manufactured sustainably. This is fueling growth of the vegan cosmetics marketplace, which is expected to grow at a CAGR of most 6% to reach $25.3B by 2029.

Every bit the skincare market becomes more crowded than e'er, it's important for brands to build stiff connections with their customers. Glossier, for example, has been working on a social commerce projection designed to connect customers with the visitor and with each other. Edifice its ain platform could help insure Glossier against the possibility of Instagram's influence turning confronting it, while giving the brand a more directly relationship with customers.

Ultimately, while millennials are more conscientious consumers of skincare products than generations before them, that hasn't slowed down their spending. Armed with the ability to easily research new skincare companies, and faced with a wider range of niche brands than ever, millennials are buying far more skincare products than whatever other generation.

It's up to the skincare brands to now capture that attention, deliver products that match millennials' preferences (such as sustainable practices and natural ingredients), and nurture that connection over the long term.

Transportation

10. Automotive manufacture

MILLENNIALS STILL WANT TO DRIVE — THEY But WANT CHEAPER, MORE EFFICIENT VEHICLES

Despite their concern for the environment and reputation equally bicycle riders and public transportation commuters, a large portion of Generation Y is only equally groovy to become backside the wheel as their parents were. They now represent 45% of first-time auto owners, and in terms of vehicle-miles traveled, millennials actually drive more than other generations (controlling for factors like spousal relationship and urban living).

Data published in Experian'southward Market Trends Review indicates that, of all generational cohorts, millennial and Gen Z consumers were the only ii demographics that spurred auto industry growth during Q3'20.

The aforementioned trend can exist seen in vehicle registrations. In 2019, millennial drivers deemed for 26.iv% of all new vehicle registrations. In 2020, that figure climbed to 28.6%.

"Millennials had all merely been written off as a serious customer grouping in the automobile industry. But information tells a much different story. The demographic is maturing and is now poised to exist a driving force in automotive marketing." — Marty Miller, senior automotive industry consultant, Experian Automotive

As a primal demographic, millennials' preferences have the power to shape trends in the automotive industry.

While older cohorts may favor luxury vehicles, such every bit loftier-end sedans and SUVs, millennial motorists announced more open to sedans, which are generally smaller, more efficient, and more affordable. In a 2019 survey, 86% of younger millennials and Gen Zers who don't ain a sedan said they would consider buying one at present or in the future — 8 percentage points higher than the average beyond generations.

Today, SUVs are outpacing sedans. In 2019, SUVs outsold sedans by a ratio of 2:ane, a trend that showed no signs of reversal by 2020 when sedans accounted for just 7-nine% of total sales amongst auto giants Ford, GM, and Stellantis. Nonetheless, if millennials keep to flood into the personal car market — a trend that accelerated even further in the pandemic — sedans could run across a rebound.

While American automotive manufacturers accept shifted their focus to the SUV and crossover markets, many foreign automakers remain committed to sedans, wagons, and other models, with the expectation that sedans volition continue to command interest.

Millennials too have a demonstrated preference for foreign-made vehicles. Of the 10 most popular vehicle brands amid millennial consumers, but 2 are American. Japanese automakers Honda, Nissan, and Toyota — routinely rated equally amidst the most reliable vehicle brands in the globe — typically top the list of the virtually popular vehicle brands amid millennial consumers.

Another market place that some analysts expected would see significant growth among the millennial accomplice in coming years was that of the electrical vehicle (EV) market. Given many millennial consumers' preferences for environmentally sustainable products, some industry experts predicted that sales of EVs would steadily increase as millennials gained greater purchasing power.

Even so, mayhap surprisingly, millennials are not as partial to EVs as expected. A survey conducted in 2017 indicated that equally many as lxx% of millennial respondents had niggling or no interest in purchasing an EV, specially among first-time buyers. Millennials' environmentally witting purchasing decisions and awareness of climate change have not yet translated into purchases of EVs.

This may, even so, be an economic conclusion rather than an environmental one. A bulk of millennials (57%) and Gen Z consumers (56%) favor the gradual phasing-out of internal combustion engine vehicles by 2035, compared to just 38% of baby boomers and 45% of Gen Ten.

But with many millennials seeking reliable secondhand vehicles over new purchases, the perceived toll bespeak and reliability of EVs may be dissuading them from making the leap from gasoline to battery ability. This trend appears to have been accelerated past the Covid-xix pandemic, with 71% of non-vehicle owners expressing an involvement in traditional gasoline-driven vehicles compared to merely 6% who expressed an interest in purchasing an EV equally their first automobile.

While millennials are leading the surge in machine purchasing, whether they shift their attention to EVs will depend on whether they can afford them.

12 Industries That Volition Thrive Cheers To Millennials

Millennials are 1 of the largest generations in history, and they're hitting their prime spending years. Get the full report to notice out virtually the industries that stand to benefit the most.

eleven. Micromobility manufacture

FOR URBAN MILLENNIALS, MICROMOBILITY Will BE THE Cardinal TRANSIT Option OF THE Future

In recent years, Gen Y has been pivotal in the tendency of resurgence in America'south urban areas. Not only exercise they have a significant preference for city living, they are also 21% more likely to purchase their homes well-nigh city centers than Gen Xers. For the cohorts aged 25-34 and 35-44, the critical factor in that decision is admission to transit, co-ordinate to a Journal of Regional Science study.

While the coronavirus pandemic had a powerfully disruptive impact on where many Americans decided to make their homes — New York City saw a 487% year-over-year increment in people leaving the city during the height of the pandemic, for example — it seems probable that millennials' love of urban centers will endure, at least for the foreseeable future.

Given that millennials make up America's largest generation, that is positive news for the sector of the transportation industry nigh primed to capture the hereafter urban marketplace: micromobility.

Pre-pandemic, micromobility services — including ride-hailing platforms similar Uber and Lyft, bike-share programs like New York's Citi Cycle, and electric scooter rental services like Bird and Lime — grew rapidly. In 2018, there were more than 85,000 e-scooters bachelor for hire in 100 cities across the Usa, with more than 38.5M trips made in 2018 alone. Equally a whole, the micromobility sector was expected to be worth up to $300B by 2030.

The coronavirus pandemic changed all that.

The lockdown measures necessitated past Covid-nineteen stopped the micromobility market'southward upward trajectory practically overnight. With significant reductions in personal trips and general distances traveled — reductions of betwixt 60-70% in passenger-kilometers traveled, according to some estimates — micromobility startups were hit difficult.

However, as confidence in vaccine programs increases and people begin to resume their lives, micromobility startups could still accomplish strong overall growth if they prioritize longer-term objectives and successfully navigate shorter-term challenges.

American cities in particular remain ideal environments for micromobility startups. Roughly 60% of all trips made in the U.s. are 5 miles or less, and e-scooters and east-bikes tin can be much more efficient than driving for such distances.

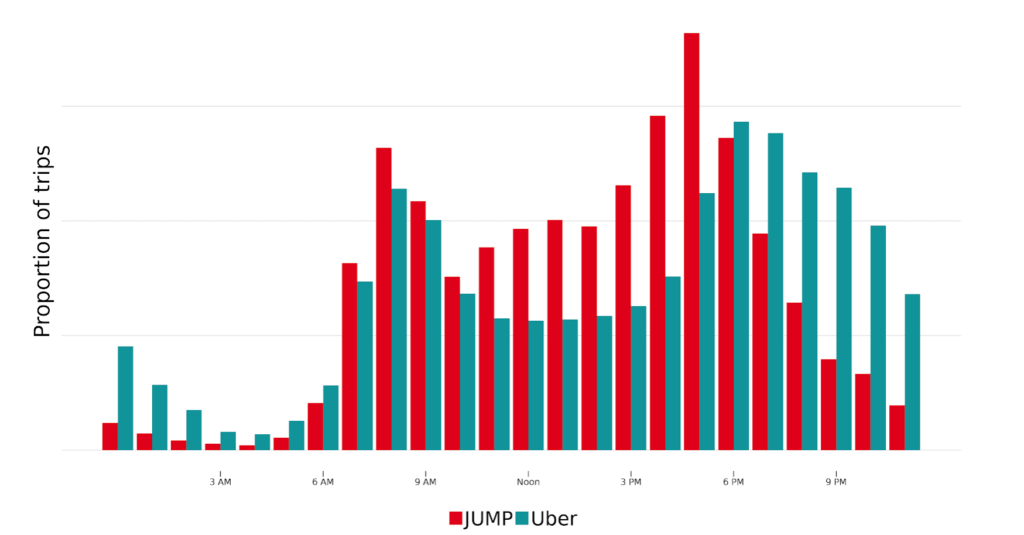

In 2018, for instance, Uber noted that its shared e-bike platform Jump was cannibalizing its ride-share business during tiptop hours:

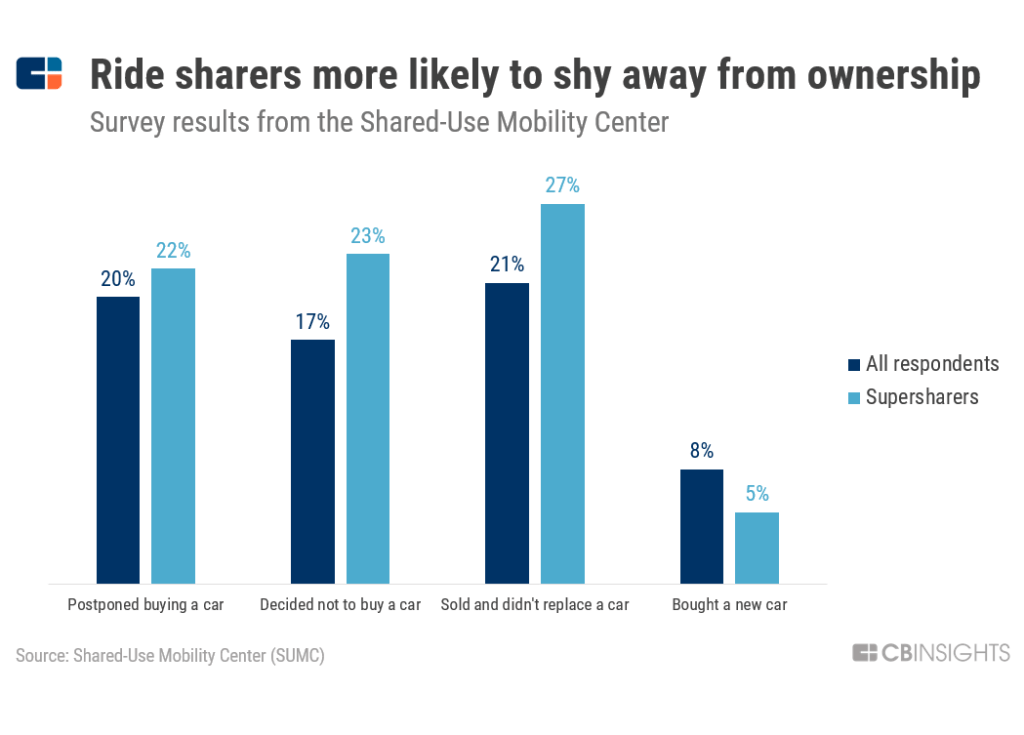

Peak users of services like Jump and Uber are also significantly less likely than other respondents to buy a new car, according to the Shared-Use Mobility Center:

Many players in the micromobility infinite continue to develop new products to entice wary travelers dorsum onto the roads, remaining confident in their future growth prospects. Lime recently unveiled its new e-mopeds in Washington, DC, and Paris, and the company hopes that consumers' growing preference for safe, affordable, socially distanced transportation will translate into increased usage and further growth.

Bird acquired Berlin-based micromobility company Circ for an undisclosed sum in early 2020, but laid off approximately 30% of its workforce afterward that twelvemonth due to a decrease in annual revenue of 37%. Despite these setbacks, Bird announced its intentions to go public via SPAC in 2021, and the visitor predicts it will go profitable past 2023.

Top automakers in America and around the world have begun working on their own micromobility projects to capture the demand for a more affordable, efficient course of transport, especially inside America's urban cores.

In belatedly 2018, Ford bought e-scooter visitor Spin for a reported $100M, and the visitor has been operating a docked bike-share plan in San Francisco and the Bay Surface area since 2013. Spin originally planned to expand into the German, French, and United kingdom markets in 2020, just these plans were put on concord by the coronavirus pandemic. The company has since appointed a new CEO and intends to launch a new range of eastward-bikes in select cities in the US and Europe, moves that the company hopes will close the gap between Spin and competitors like Bird and Lime.

Other legacy transportation companies trying to adjust to a micromobile world include BMW, which is building its ain line of electric bikes and motorcycles; Harley-Davidson, whose Serial 1 electric wheel went on sale in March 2021; and Audi, which is edifice electrical mount bikes.

Other manufacturers have reevaluated their plans to enter the micromobility market entirely. Full general Motors, whose Ariv e-bikes had been deployed in several European cities as part of a express pilot in 2019, decided to terminate its line due to the impact of Covid-19.

1 of the keys to success with micromobility will be the power to work with municipalities to bring scooters and bikes to the road in a sustainable manner. Although some municipalities have welcomed micromobility startups with open arms, others have been resistant to assuasive them to operate within metropolis limits.

The urban center of Santa Monica, California filed a criminal complaint against Bird afterwards the company deployed its fleet of eastward-scooters in 2017, and city attorneys in San Francisco issued stop-and-desist letters to Bird and Lime in 2018, claiming the scooters were a public nuisance.

Several other cities across the Usa, including Nashville, San Antonio, and Seattle, accept introduced legislation in contempo years either restricting or outright banning micromobility startups from operating in those cities following complaints, accidents, and fatalities.

For micromobility companies looking to capitalize on millennial consumers, a primal claiming will simply exist figuring out how to operate in the urban geographic locations that the generation prefers.

Finance

12. Personal finance industry

MILLENNIALS ARE INCREASINGLY TAKING CONTROL OF THEIR MONEY WITH APPS, Non BANKS

Despite existence saddled with the highest student loan debt of whatever generation and the fastest-rising cost of living in a decade, millennials are oftentimes characterized as existence inept when information technology comes to their finances.

The reality, however, is that nearly one-half of millennial Americans are actively saving for emergencies, retirement, and even time to come homes. Despite lower earnings than Gen Xers or baby boomers had at their age, millennials are more likely to have savings goals, manage their debt improve, and exercise a ameliorate job of sticking to their budgets.

Generation Y's secret weapon when information technology comes to navigating budgeting, saving, investing, and spending — even with depressed wages and a less-than-desirable job market place — is technology.

Millennials brand upwards the vast majority of users of spider web and mobile personal finance apps, which are twelvemonth by year becoming increasingly pop tools to assistance users better understand, organize, and improve their finances.

Source: Robinhood

With more than one-half of American smartphone users using at least 1 full-service banking app and almost one-5th using a standalone budgeting app, consumers beyond demographics are embracing fintech products. Gen Y users, though, rely on mobile banking and standalone budgeting apps even more than their older counterparts. Personal budgeting apps are particularly popular with millennials, with approximately 70% of the user base of these apps belonging to the millennial cohort.

One of the most pop verticals for personal finance tech is banking. In 1 survey, 71% of millennials said that they would rather go to the dentist than listen to what a bank has to tell them — a sentiment driven largely by poor customer service and poor technological integration. To this end, only 25% of millennial financial consumers would prefer to get their financial advice from a human being being, with the vast bulk preferring the cocky-service route via apps for mobile devices.

That distaste has created a huge opportunity for digital-first challenger banks like Revolut, Chime, Nubank, Qapital, Monzo, N26, and Uala. In 2018, CG42'southward retail banking study predicted that the 10 largest banks would lose more than $340B in deposits to this upstart brand of contest over the post-obit yr alone. The Covid-19 pandemic accelerated these trends even further: since the emergence of Covid-nineteen, online banking has increased by 23%, and mobile banking has increased by thirty%.

Many fiscal analysts see these trends equally lasting changes rather than temporarily anomalies. In the coming years, Boston Consulting Group predicts an additional 19% increase in mobile banking employ and a 26% reduction in the apply of brick-and-mortar branches — and that's in addition to the 12% reduction in branch usage already observed during the pandemic.

Millennial adoption has also fueled the growth of robo-investment advisors like Betterment ($29B in avails under management, or AUM), Wealthfront ($15.8B AUM), and Personal Capital ($13B AUM).

Digital brokerage Robinhood was valued at $11.7B equally of September 2020, and is expected to go public in 2021 at a valuation of up to $40B. In 2019, it reported that fourscore% of its assets under management come from millennials.

Equally the speedily rising toll of living continues to squeeze already struggling millennials, it's inevitable that demand will remain loftier for personal finance apps that tin help cash-strapped consumers make informed decisions.

To stay relevant, legacy financial institutions will demand to offer mobile apps that are both technologically sophisticated and simple to use. These apps may use technologies similar Face up ID for quick login, offering integrations with the other financial products similar Robinhood that millennials are using, and exist built as consumer products first — non portals into a web interface from the 1990s.

If you lot aren't already a client, sign upwardly for a free trial to learn more well-nigh our platform.

Source: https://www.cbinsights.com/research/report/millennials-industries-thriving/

0 Response to "Baby Boomers and Genx Expenditures on Cannabis Chart 2019"

Enregistrer un commentaire